Contents:

However, when using options, traders are required to pay some commissions, which can act as additional costs for Forex traders. When it comes to the best hedging strategy in Forex, one option that should be discussed is options trading. This strategy can be a great fit for traders who do not like to have several positions open in the market at once. This strategy lets traders buy or sell currency at a predetermined rate before a specific date. Using CFDs is considered one of the best Forex hedging strategies, as it allows traders to easily go short or long. This strategy sees traders opening a contract with the broker solely based on the price direction the currency pair is expected to take.

Rupee does better than peers, importers advised to hedge — The Economic Times

Rupee does better than peers, importers advised to hedge.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

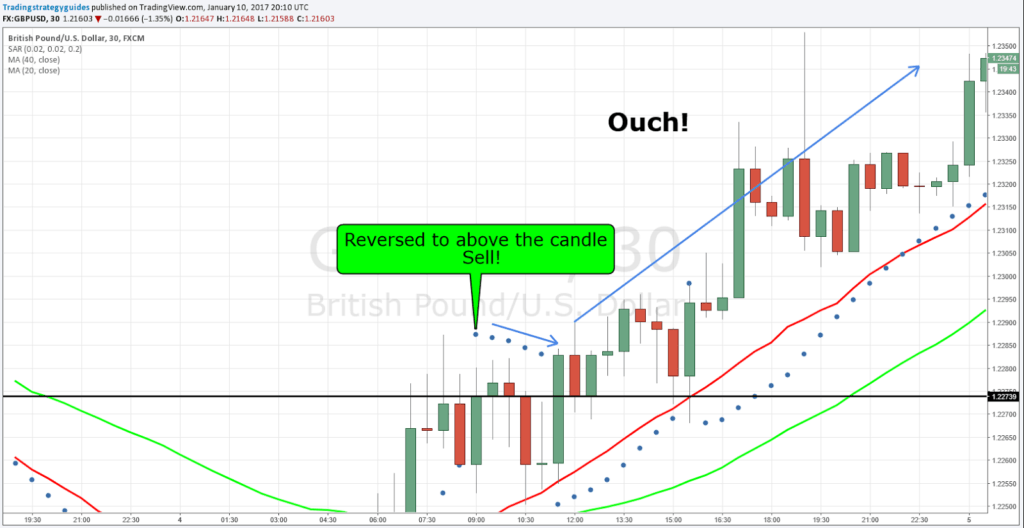

Although modified durationing a currency pair that you hold long, may sound bizarre because the two opposing positions offset each other, it is more common than you might think. A direct hedge occurs when you are permitted to place a deal that purchases a single currency pair, such as USD/GBP. You can also place a transaction to sell the same pair at the same time. While the net profit of your two transactions is zero while both are open, if you time the market correctly, you can make more money without incurring additional risk. The 3 most popular hedging strategies to reduce market risk are the modern portfolio theory, options strategies and market volatility.

Hedging Strategies in Forex Trading for Risk Management

The market has a low success rate and therefore traders may end up losing money rapidly while trading forex. With the forex hedging strategies, traders can analyze the market, know their market positions, trade in different styles, they can either go long or short depending on the market situation. So, in a small aspect the forex hedging strategies are a necessary tool for managing market volatility, thus minimizing the market risks.

- Finally, traders need to bear in mind that hedging also requires a larger amount of capital.

- A forex option enables you to trade an FX pair at a set price before a predefined time has elapsed.

- By using a forex hedge properly, an individual who is long a foreign currency pair or expecting to be in the future via a transaction can be protected from downside risk.

- This simple agreement protects against unexpected losses and allows businesses to operate without the need for immediate payment.

- They are commonly used by large corporations and financial institutions.

In that case, you can limit the exchange rate risks and lock in the current exchange rate between USD/INR by entering into a forex forward contract. Hereon, any adverse shift in the exchange rate of USD/INR will not affect you due to the already hedged forex position. If the prices start falling constantly, a short position in the bearish market help traders have a successful trade. Hedging provides traders with extreme flexibility to enter or exit the market according to the trader’s convenience. This means if a trader has opened a long hedge position, but there is a downtrend in the market, they can exit the market quickly by closing the original short and hedged long position. Whereas, if a trader has a hedged short position opened in the same falling market, they can exit the original long and hedged short position to balance the overall trade value.

Three forex hedging strategies

This can also be a strong strategy when a pair is particularly volatile. For example, EUR/USD has been setting high highs and lows as the confidence in the dollar swings back and forth. Hedging your forex trades can lower your risk — if you learn how to do it right. Full BioSuzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. However, if the yen had risen in value instead, you could let your position expire worthless and only pay the premium.

Options and Futures can be used in short-term strategies, to reduce the risk for long-term traders. They believe that since they are fully hedged, there is no risk. Otherwise, their Forex hedging strategy can suddenly lead to bigger losses. This broker platform supports heaps of instruments, like cryptocurrency and stock CFDs, and there are well over 50 different currency pairs available.

Hedge in forex is a way to reduce market risks if the market starts trading against your preferred direction. This means, if you have a long forex position and the market starts falling, a short hedged position will help you cover the losses. Whereas, if you have a short position and markets start rising, a long hedged position will protect you against the losses. It is not legal to buy and sell the same strike currency pair at the same or different strike prices in the United States.

Forex Correlation Hedging Strategy

Many people are turning to forex trading during lockdown, and it can make for a strong investment strategy. Moreover, risky currency pairs are becoming more profitable, and traders who want a piece of this volatile pie need to hedge well—but also know when to de-hedge. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters.

However, when it comes to payment methods, it is important to note that if you deposit via a bank transfer then it can take days to go into your https://1investing.in/ account. Most broker sites allow customers to deposit using a variety of payment methods such as a credit/debit card, bank transfer, and e-wallets like PayPal. Some companies even allow traders to pay via certain cryptocurrencies such as Bitcoin, although granted, it is not as commonly seen as Visa. 4 pips might not sound like a lot, but in the forex broker space, it is considered expensive. When it comes to functions, there are a few terms you will see regularly when hedging in forex.

It is also not permitted to hold short and long positions of the same currency pair in the U.S. However, many global brokers allow forex hedging, including the top UK forex brokers and even many of the top Australian forex brokers. There are many financial hedging strategies you can employ as a Forex trader. Understanding the price relationship between different currency pairs can help to reduce risk and refine your hedging strategies. Second, risk and reward parameters of hedging are usually proportional, or when a trader reduces risk exposure, he/she also reduces profit potential.

Each currency has a different overnight interbank interest rate, and because you trade Forex in pairs, you also deal with two different interest rates. As the largest financial market globally, Forex trading is one of the most popular investment avenues for many. The liquidity and huge trading volume make Forex trading an option worth exploring. A trade can be hedged by opening a position that is opposite to the current open position. So, if you have a long open position, you hedge by opening a short position.

These two types of investment strategies are useful but it all comes down to what you’re trying to achieve. When the oil price strengthens, the USD/CAD exchange rate will weaken. The following section details some disadvantages of using hedging strategies. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted.

Get Started with a Forex Broker

However, they also have their drawbacks, such as increased trading costs and the potential to limit profits. Understanding the pros and cons of each strategy is crucial for determining the best approach to managing risk in your trading. Moreover, implementing effective hedging strategies in forex trading can provide you with peace of mind. When you know that you’ve taken steps to protect your investments, you can trade with more confidence and focus on making informed decisions. With currency options, banks offer exporters an opportunity to buy or sell a certain amount of currency at a fixed price, on or before an agreed date.

Many professional traders interested in trading currencies online opt for day trading, being drawn to its excite… Hedging is all about reducing your risk, to protect against unwanted price moves. Obviously the simplest way to reduce the risk, is to reduce or close positions. But, there may be times where you may only want to temporarily or partially reduce your exposure. Depending on the circumstances, a hedge might be more convenient than simply closing out.

As the portfolio method shows, you can create simple hedges that cover multiple positions. Intrinsic value is the difference between the strike price and the current price for an in-the-money option contract. Put options give the owner the right to sell shares or currency at a given price.

Leave a Reply